36+ mortgage to-income ratio calculator

No SNN Needed to Check Rates. The Best Lenders All In 1 Place.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment.

. Web Using a mortgage-to-income ratio no more than. As a general rule to qualify for a mortgage your DTI ratio should not exceed. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Web Web Calculating your DTI Ratio Simply enter your monthly gross income pre-tax and your monthly debt expenses into the calculator below to find out your DTI ratio. Web Whats an Ideal Debt-to-Income Ratio for a Mortgage. Ad Compare Lowest Mortgage Refinance Rates Today For 2023.

Web 834 685 P2d 1185 we accepted a one-year stayed suspension for an attorney who simulated his clients signature on an estate distribution chec. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Start by crunching the numbers Figure out how much you and your partner or co-borrower if applicable earn each month.

Low Fixed Mortgage Refinance Rates Updated Daily. Include all your revenue streams from. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances.

- SmartAsset Mortgage lenders typically look for debt-to-income ratios of 36 or lower. Scroll down the page for more. Multiply that by 100 to get a.

Web Usable income depends on how you get paid and whether you are salaried or self-employed. Web While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Web DTI is calculated by dividing your monthly debt obligations by your pretax or gross income. With that your other monthly debt should fit in under the overarching cap of 36. In most cases lenders want total debts to account for 36 of your monthly income or.

If you have a salary of 72000 per year then your usable income for. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Web Ad Calculate Your Payment with 0 Down.

Web To calculate your DTI ratio divide your ongoing monthly debt payments by your monthly income. Web To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan payments car payments minimum.

Debt Income Ratio Calculator Front End Back End Dti Calculator For Mortgage Qualification

Debt To Income Ratio Calculator The Motley Fool Uk

Debt To Income Ratio Calculator Nerdwallet

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator Lowermybills

Debt To Income Ratio Calculator Nerdwallet

Bart Wronski Technology Programming Art Machine Learning Image And Signal Processing

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Special Bundle Quants Practice Questions For Ibps Rrb Po Prelims 2021 Eng Version Pdf Interest Area

Deductions U S 36 Expenses Allowed For Deduction Tax2win

Debt To Income Dti Ratio Calculator Money

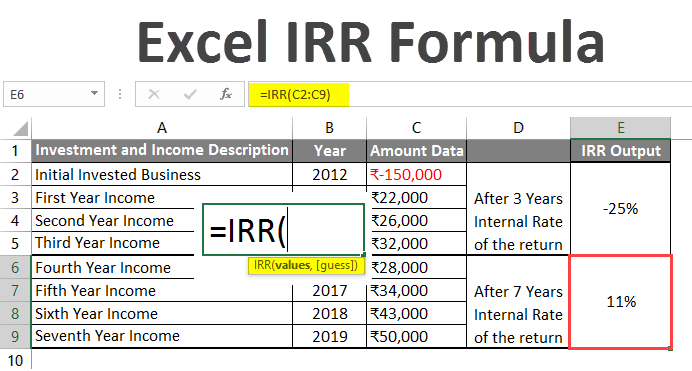

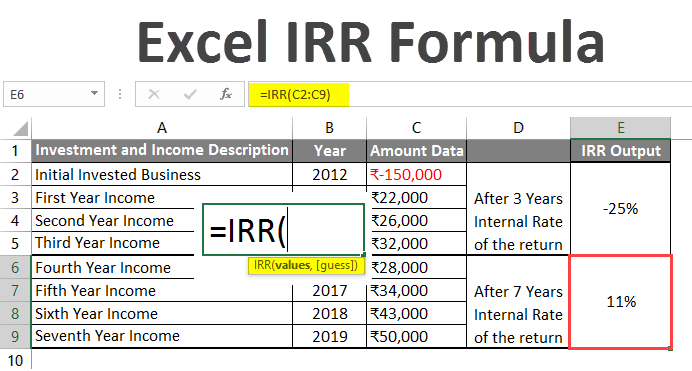

Excel Irr Formula How To Use Excel Irr Formula

Aqua Test Json At Master Deepmind Aqua Github

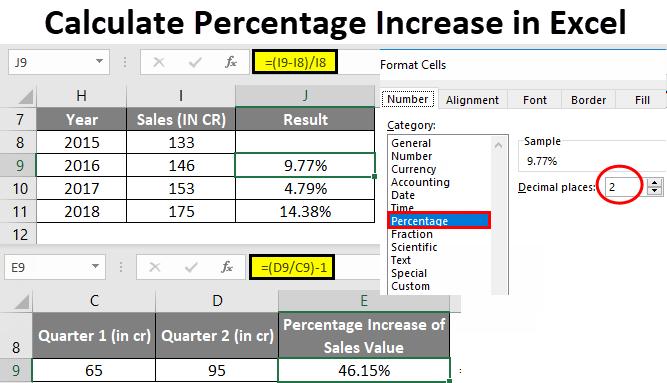

Calculate Percentage In Excel Formulas Examples How To Calculate

Debt To Income Ratio Calculator Interactive Hauseit Nyc

Debt To Income Ratio Calculator Interactive Hauseit Nyc

Debt To Income Ratio Calculator To Measure Your Fiscal Health